Digital health equity funding has roared back to life in Q1 2025, with mega-rounds and unicorn births not seen since the boom times of Q2 2021. But this time it feels different — less fluff, less noise, and more substance. Why are investors opening their checkbooks once again for healthcare innovation?

The Numbers

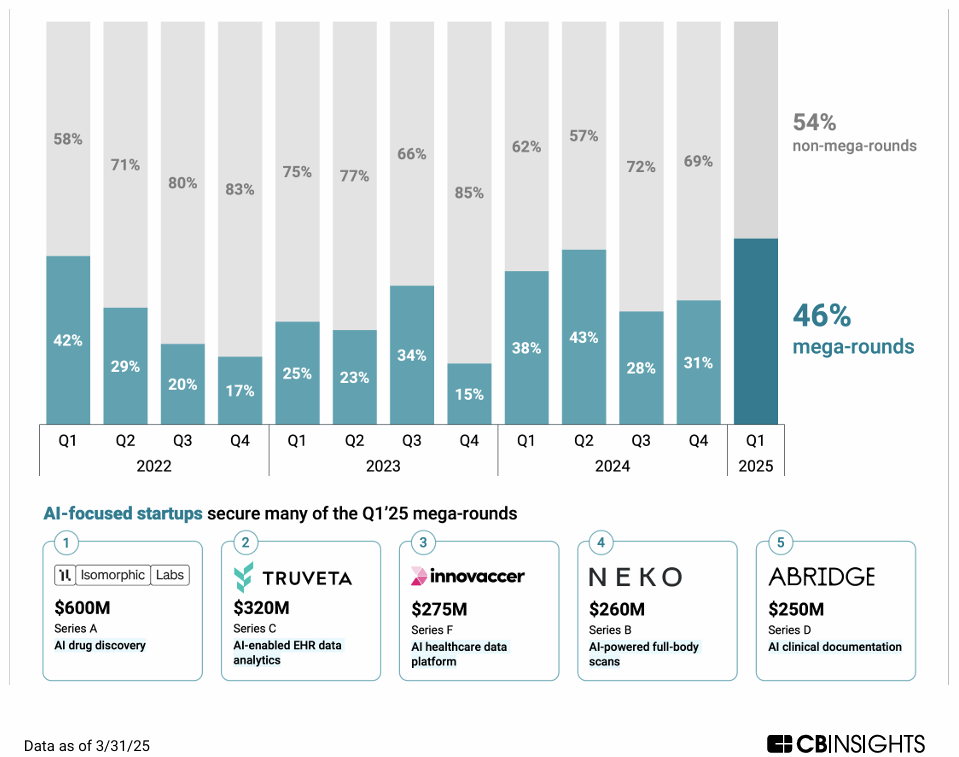

Q1 2025 has comprehensively broken the digital health funding slump in recent years with $5.3 billion invested - equating to a 47% jump from last quarter and representing the highest total since Q2 2022. The biggest substory? Mega-rounds are making a dramatic comeback. These $100M+ deals totaled $2.5 billion across 11 companies, more than doubling Q4's figures

CB Insights. (2025). State of Digital Health: Global Q1 2025.

These mega-rounds are capturing 46% of all funding, a dominance we haven't seen since Q4 2021. At the same time, the overall number of equity deals dropped 9%, suggesting investor selectivity over broad-stroke enthusiasm. The global median deal size jumped from $5.4M to $6.4M, suggesting VCs are concentrating their bets on companies they believe have clear paths to success.

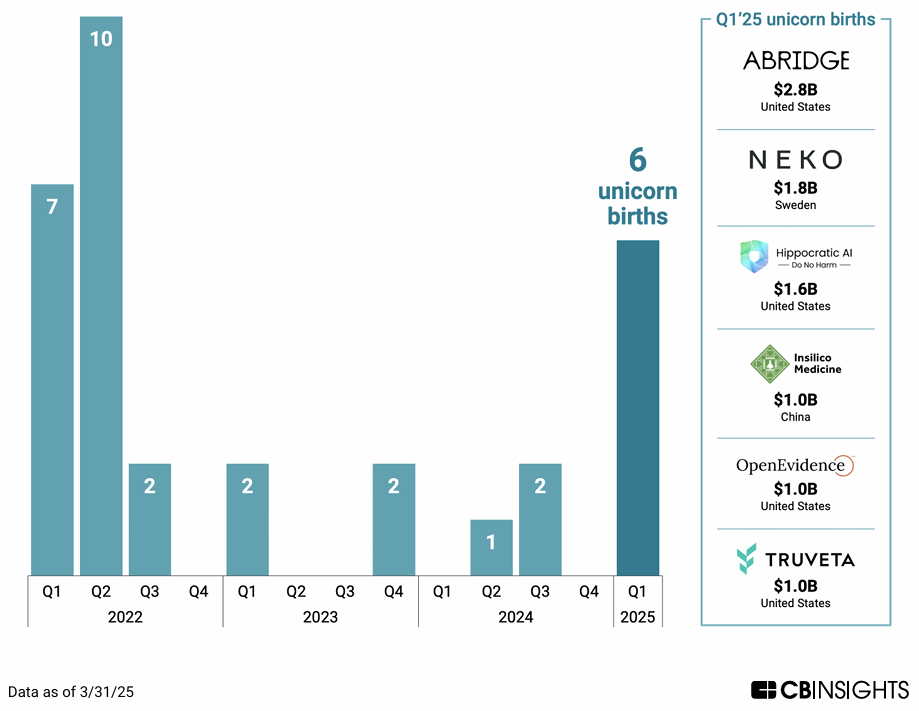

Perhaps the most striking indicator of renewed investor confidence is the dramatic resurgence in unicorn births. Q1 2025 saw 6 new digital health companies reach the $1 billion valuation milestone—more than all of 2024 combined and the highest quarterly total since Q2 2022.

Fig 2. Quarterly unicorn births in digital health from Q1 2022 to Q1 2025.

CB Insights. (2025). State of Digital Health: Global Q1 2025.

AI has become the undisputed engine of this funding resurgence, with AI-focused startups capturing 60% of all digital health funding, up significantly from 41% in 2024. Eight of the eleven mega-rounds went to AI-powered companies, confirming that AI's gravitational pull in healthcare remains strong, despite some investors becoming disenchanted with undifferentiated AI solutions that promise transformational but only deliver incremental improvements.

The standouts include an impressive $600M Series for Isomorphic Labs, an AI drug discovery spinout of Google Deepmind led by CEO and Nobel Prize Winner Demis Hassabis, Truveta's $320M raise for EHR data analytics, and Innovaccer's $275M Series F for its healthcare data platform. It would be wrong to call this speculative AI investment—these companies have transitioned from promising technology to demonstrable solutions with regulatory pathways and paying customers. We've moved from the "AI might change healthcare someday" narrative to "AI is changing healthcare right now."

The most funded AI applications reveal where investors see immediate value creation. Clinical documentation tools like Abridge (raising $250M at a $2.8B valuation) are solving the very real problem of physician administrative burden. Hippocratic AI reached unicorn status at $1.6B by tackling patient follow-up—a critical but historically resource-intensive task.

Market Dynamics Fueling the Surge

Beyond technology trends, several market forces are converging to drive this investment resurgence. Q1 2025 has shown us that investors are showing a clear preference for later-stage startups with regulatory milestones and scalable AI platforms, seeking more certain returns in a still-evolving landscape.

The exit environment has also improved dramatically, with M&A activity up 27% to 51 deals in Q1. Notable acquisitions like CentralReach ($1.6B) and Alto Pharmacy ($1.5B) demonstrate renewed buyer interest in scaled platforms with proprietary data.

The macroeconomic picture has shifted too; lowered ECB interest rates have eased borrowing costs for both healthcare providers and digital health startups, making technology adoption and expansion efforts suddenly more feasible. Although interest rates remain stable in the US, drops are expected later in the year.

Regional Differences

Geographic trends reveal important divergences in the digital health landscape. The U.S. dominates with 55% of global deals and 64% of funding, benefiting from strong healthcare IT adoption and AI infrastructure. However, this concentration exists despite potential economic headwinds, including tariff policies that have been shown to increase costs for medical supplies and components critical to digital health innovation.

Europe presents a mixed picture: fewer deals overall but surprisingly robust unicorn creation and significant mega-rounds. The region accounted for 21% of global deals but saw three notable mega-rounds totalling $1 billion in Q1 2025. The UK's Isomorphic Labs secured an impressive $600M Series A, while Sweden's Neko Health raised $260M at a $1.8B valuation. Additionally, Ireland-based FIRE1 closed a $120M Series D round. European investors showed particular interest in early-stage companies, with 68% of deals going to early-stage startups compared to 42% in the US. The region also demonstrated great geographic diversity in its investment landscape, with significant deals spread across the UK, Sweden, Ireland, Germany, Spain, Belgium, and Iceland. European investors like Bayern Kapital, Creandum, and Lakestar were particularly active in the quarter. Asia, particularly China, continues its slowdown with deal volume down 24% year-over-year, reflecting ongoing regulatory challenges and reduced access to Western markets.

Q1 2025 - A Sustainable Recovery or a Blip?

While Q1's funding surge echoes the 2021 boom, key differences suggest greater sustainability. Today's funded companies demonstrate measurable clinical outcomes and tangible customer traction, all with clearer paths to profitability. Capital is concentrating on proven performers, with median deal sizes increasing to $6.4M while overall deal count decreased by 9%. The exit environment has also improved, with M&A activity up 27% and two $1B+ acquisitions validating venture-scale returns. However, macroeconomic shifts, regulatory uncertainties, and healthcare's traditionally slow adoption cycles keep things complicated, and remain significant risks to continued momentum. It's healthcare, after all—complexity is always part of the equation.

Final Thoughts

This resurgence marks a maturation of sorts for digital health investing—moving from speculative excitement to value-driven funding. As the sector shifts toward sustainable solutions with measurable impact, we're witnessing not just a funding recovery but a fundamental evolution in how healthcare innovation is financed, developed, and deployed. The question is no longer whether AI will transform healthcare, but which specific applications will deliver the most value for patients, providers, and investors alike.